Services

Tailored Financial Planning

Our financial planning and financial advisory services start with understanding your situation and developing a written list of your goals and concerns. From there, we cover a wide range of financial planning issues in an integrated fashion.

Retirement Planning

Whether you are already retired or planning to retire, you want to know how long you can sustain your desired level of spending and what changes need to be made.

Income Tax Planning

Consulting to spot tax-minimization opportunities by reviewing your current situation and by preparing forward-looking cash flow and tax projections

Investment Advisory

We review your current asset allocation and investment choices across all your investments and discuss any hidden fees that you may be paying.

Estate Planning

Getting clarity on your estate planning documents and beneficiary designations is critical – it is too important to ignore.

Risk Management

Having the right amount of insurance determined by an objective review will help protect your assets without overpaying for insurance that may be “sold” to you.

Life Planning

Planning is much more than just looking at numbers. Life-integrated planning involves exploring living an intentional life with the financial clutter in the rear-view mirror.

Service Offering

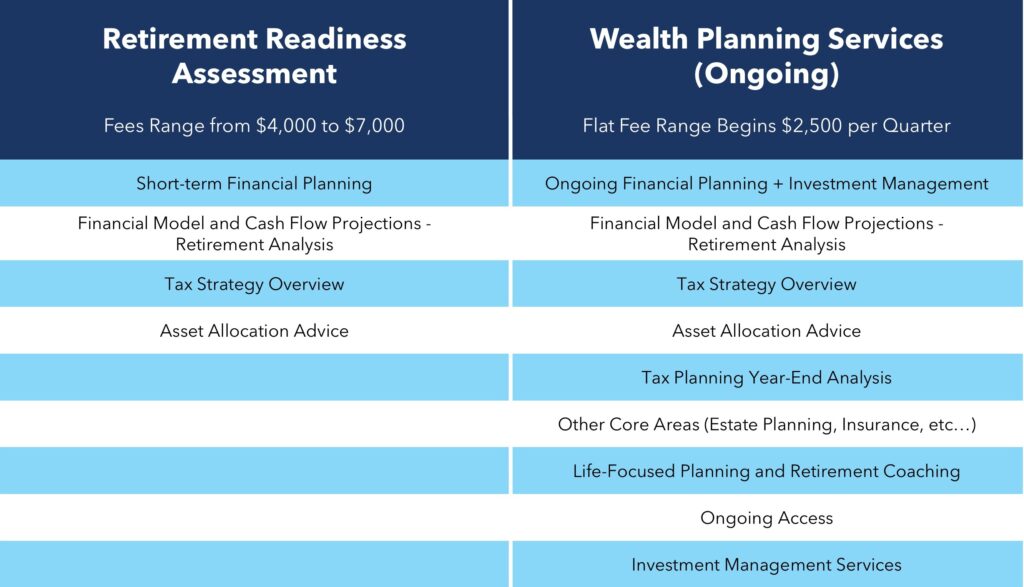

We offer two service options. Our flagship services are our Wealth Planning Services where you would receive ongoing advice, education, and implementation assistance and includes holistic financial planning, tax planning, and investment management. You would receive the greatest service and value from our Wealth Planning Services. If you are looking for an ongoing partnership with a fiduciary advisor, our Wealth Planning Services would be an ideal fit. Our Retirement Readiness Assessment is a good option for those seeking a one-time review of key issues of planning for retirement in an integrated manner.

Investment Management

Our financial planning and financial advisory services start with understanding your situation and developing a written list of your goals and concerns. From there, we cover a wide range of financial planning issues in an integrated fashion.

Matching Approach to Asset Allocation

Your investment asset allocation is tied to a variety of your goals, including your cash flow needs in retirement.

Evidenced-based Investing

While staying diversified, we seek to tilt our allocations for favorable long-term returns.

Ties To Your Financial Plan

Your situation is unique. Your investment management program should tie to your unique needs and evolve as your situation changes.

Act As a Fiduciary

As fee-only fiduciary advisors, we have chosen to put our clients' interests first. It is more than a legal standard – it is how we think clients should be treated.

Index-investing With a Twist

Low-cost approach that lies between passive investing and active investing.

Education And Behavioral Coaching

We value our role as teacher so that you will have confidence in the long-term strategy. To avoid the mistakes that so many do-it-yourselfers make during market volatility, you receive coaching along the journey.